Weekly macroeconomic and market update 09.08.16

Weekly macroeconomic and market update

A look back over macroeconomic events for the week ending 05/08/2016. The Bank of England unveiled a two-pronged monetary stimulus, cutting rates and re-starting quantitative easing (QE). This came in response to a deteriorating economic outlook, highlighted in its quarterly inflation report and supported by some of the leading economic indicators in the UK. Over in the US, job numbers muddied the water on the US economic outlook.

Bank of England announces a new stimulus package

The Bank of England revealed a market-pleasing stimulus package on Thursday, coinciding with the release of its quarterly inflation report, to frame the Central Bank’s thinking. Read our full note here. Interest rates were cut in line with market expectations, by 25 bps to 0.25%, along with the announcement of an unexpected Term Funding Scheme (TFS) aimed at getting this rate cut through to the real economy.

Also generally unexpected was a restarting and expansion of QE, which many thought would be held in reserve. Evidently the Bank Governor, Mark Carney, was looking to make more of an impact. The scale of QE will include buying £60 billion of government bonds, as well as up to £10 billion of corporate bonds, borrowing an idea currently being implemented by the European Central Bank.

All in all, this package was a little bit more than markets expected, but from our point of view the problem remains that unconventional monetary policy is all but discredited. This measure is not aimed at boosting the economy, but rather trying to manage a slowdown. To achieve this, the action will need to be coordinated with fiscal stimulus, which we expect to be announced by the Government in the second half of the year.

But the outlook is less than rosy

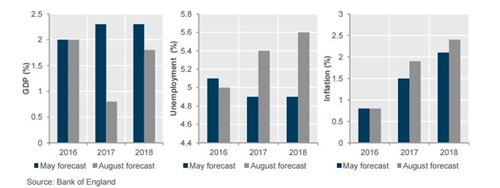

Whilst stimulus might have been welcomed by the market, the less-than-rosy reasons were clearly laid out in the quarterly inflation report. This pointed to lower growth, higher inflation and higher unemployment in the wake of the EU referendum. During the press conference, Mark Carney highlighted concerns that business investment would be hit almost immediately, with employment and consumer demand following thereafter – the delayed effect of monetary policy, prompting the committee to act now. GDP for next year was revised sharply down by 1.5% from 2.3% to just 0.8%.

This is not quite in recessionary territory, but a marked slowdown, and forecasts from the bank tend to be somewhat optimistic here. Rather than falling, unemployment is now forecast to start rising, and with base effects as well as the weaker currency, inflation is expected to overshoot the 2% target in 2018, hitting 2.4% before falling back.

As elsewhere, the Central bank is somewhat caught between faltering economic growth, and rising inflation – whilst stagflation might be the resulting suggestion, it’s worth highlighting that much of this is externally driven, so unlikely to be a major concern for the moment. Our house view remains highly sceptical on unconventional monetary policy, so unlike previous rounds, we no longer favour equities as beneficiaries from QE. The potential for fiscal stimulus could provide some relative support, though not for bond markets, which may not take kindly to a deliberate widening of the deficit.

Non-farm payrolls put pressure on the Fed to take action

Across the pond, US non-farm payrolls again came out significantly ahead of expectations – adding 255,000 jobs in July, compared to expectations of 180,000. The similarly strong June reading was also revised up, reinforcing a picture of a pretty healthy US labour market after concerns in May.

Unemployment was unchanged, but average earnings also improved ahead of expectations (0.3% month on month from 0.1% in June and 0.2% forecast). The participation rate also ticked up 0.1% to 62.8%. With employment strong and inflation picking up, there will be pressure on the US Federal Reserve (Fed) to start increasing interest rates. But as we saw with the disappointing GDP figures recently, the wider economic picture remains challenged, and we still believe Fed action remains less likely than the market expects.

Last week’s other events

- Chinese official Manufacturing PMI for July just about slipped into contraction at 49.9 from 50. Interestingly the private Caixin measure, which is more sensitive to smaller companies, improved much more than expected from 48.6 to 50.6 (48.7 was forecast) – the first expansionary reading since early 2015. Official non-manufacturing came in at 53.9 (from 53.7) whilst the Caixin services reading slipped from 52.7 to 51.7.

- In the US, ISM Manufacturing PMI slowed to 52.6 (from 53.2), and non-manufacturing fell from 56.6 to 55.5. Core PCE inflation was unchanged at 1.6% year on year, whilst personal income and expenditures were unchanged from a month before, at 0.2% and 0.4% month on month respectively.

- Eurozone retail sales were unchanged in June, up 1.6% year on year. Forecasts were looking for a slight tick up to 1.7%, though clearly events have moved on since June.

- In Japan, the coincident index of economic activity increased from 109.9 to 110.5, though this remains somewhat subdued. The leading economic index fell from 99.7 to 98.4, extending a multi-year slowdown starting from the beginning of 2014.

Investment strategy update

The Bank of England highlighted concerns over the negative short-term impact that the Brexit vote is expected to have. This view is formed through the Bank’s own interviews and surveys with a large number of what they call ‘agents’ – businesses that are the economic agents and at the coal face. The surveys for the August inflation report included 270 such agents, employing 1.2 million people.

The results showed an expected negative impact on capital spending and hiring plans across different sectors as a result of the EU referendum. Of particular note was the consumer services sector, which expected a reduction of around 40%, and construction, which estimated a fall of 50-60%.

More broadly, some six weeks on from the referendum result we are starting to see the first few data points relating to the post-referendum period. Some are lagging indicators – they look at the past and show how things have changed from a year earlier, for example. But more interesting are the leading indicators, which indicate attitudes and expectations for the future, usually through various surveys such as the purchasing manager indices (PMIs).

What we see from the data is that there had been many signs of strong growth leading into the vote (though perhaps this wasn’t evident at the time, owing to the lag in reporting these data). GDP growth, industrial production and retail sales all showed signs of strength – but bear in mind that June data points would include partial post-vote data, likely a cause of some of the slight downward trends.

However, the leading indicators including PMI data, the ZEW business sentiment and consumer confidence indices are all sharply lower. Although some of the outwards signs of this expected slowdown may take some time to materialise, this expected slowdown and the response – likely further monetary and fiscal stimulus – will be key determinants of investment returns for the medium term, and is something we continue to watch closely.

The markets

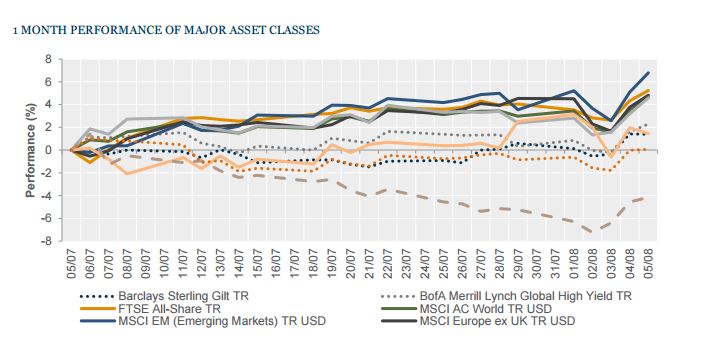

We had another fairly subdued week for markets, with equities, bonds and commodities fairly unmoved overall. The most notable action was the weakening of sterling after the Bank of England action, whilst US Treasury yields were also higher after Friday’s non-farm payrolls.

Equities – it was relatively quiet overall on the markets this week. The FTSE All-Share was up +0.9%, the S&P 500 was up +0.4%, whilst in Europe the FTSE Europe ex-UK slipped -1.0%. In the Far East, Japanese equities were typically volatile, with the Topix ending the week down -3.2%, and in Hong Kong the Hang Seng was up +0.9%.

Bonds – with the Bank of England move largely expected, 10-year gilt yields were only slightly lower by 2 bps to 0.67%. US Treasury yields rose on the week, driven by the non-farm payroll numbers up from 1.45% to 1.59% over the week. Ten-year German bunds were less negative, moving from -0.12% to -0.06%.

Commodities – oil regained a little on the week but remains well below the US$50 mark. Brent was last seen trading at US$44.30. After rallying through the week, gold gave up essentially all of its gains after the Friday non-farm payroll numbers, ending the week at US$1,329.30 an ounce, whilst copper slid through the week to finish at US$2.15 per lb.

Currencies – sterling weakened after the Bank of England action, last seen at US$1.31, €1.18 and ¥133.

The week ahead

After a few very active weeks, it is fairly quiet for the week ahead. The only data of note is due on Friday – US retail sales potentially add to the picture on the state of the US economy, with forecasts for a slowdown from 0.4% to 0.2% month on month in July. We also have Chinese Fixed Asset Investment and Industrial Production for July, and June Eurozone Industrial Production data. On Tuesday we also have UK industrial production figures for June. Elsewhere:

Chinese trade data is released early on Monday morning, followed in the afternoon by the US Fed Labour Market Conditions index. Overnight on Tuesday, Chinese inflation is forecast to have softened slightly from 1.9% to 1.8% year on year. Later in the morning UK Trade comes out, along with Industrial and Manufacturing Production figures – but all of these relate to June, so are somewhat out of date. In the afternoon, the US unit labour costs and productivity measures for the second quarter might add some depth to our understanding of what is happening in the US labour market.

On Wednesday Japanese machinery orders come out just after midnight, with Chinese Foreign Direct Investment shortly after. In the afternoon, the US JOLTs Job Openings numbers are released. These are followed by a quiet Thursday – only US import and export prices are updated.

We finish the week with a lot of medium-level action on Friday. Overnight Chinese data comes out, including Fixed Asset Investment (forecast to slow from 9.0% to 8.8% year on year), Industrial Production (expected to slow from 6.2% to 6.1% year on year) and Retail Sales (expectations for a very marginal slowing from 6.2% to 6.1% year on year). The Eurozone then reports on June’s Industrial Production, expected to have picked up 0.2% to 0.7% year on year, as well as the second estimate of GDP for the bloc. In the afternoon, the week ends with US PPI price data, Retail Sales and the Michigan Consumer Sentiment reading.

Disclaimer

This article was previously published on Tilney prior to the launch of Evelyn Partners.