Weekly macroeconomic and market update 14 March 2016

Weekly macroeconomic and market update

Draghi doesn’t disappoint

The ECB certainly didn’t disappoint in its monetary stimulus package, although markets clearly struggled to figure out how they should react. Equities initially rallied as the euro fell, before about-facing once the press conference got underway.

Largely as expected, the ECB Governing Council cut the key interest rate (the deposit rate) by 10 bps to -0.40%. The surprise came from the QE programme, which was expanded by €20 billion to €80 billion per month – double the €10 billion that the market had been pricing in. Adding to the spice, the scope of the QE programme was expanded to include senior non-bank corporate bonds, in an effort to more directly promote credit conditions in the economy, as well as a fresh range of four Targeted Long-Term Refinancing Operations (TLTROs).

Although TLTROs are more technical and less ‘sexy’ than the usual monetary policy tools, they are also important instruments for promoting credit growth in the Eurozone so it will be interesting to see how much take-up we see. Our house view remains that QE could continue to benefit Eurozone equities in the short-term, and perhaps credit spreads with last week’s changes, but increasing scepticism over the efficacy of QE policies may turn into a credibility crisis for global Central banks.

Falls in Chinese imports and exports

Chinese trade data showed further sharp falls in imports and exports, both worse than expected. The fall in exports accelerated from -11.2% in January to -25.4% in February, more than double the forecast for a -12.5% fall. Imports were down -13.8%, a slight improvement on the -18.8% previously but still a disappointment for markets expecting a -10.0% fall.

Although the effects of the Chinese New Year can distort data around this period, the scale of the swing is clearly a reason for concern. China also announced that foreign direct investment slowed from 3.2% to 2.7% year on year in February. Consumer inflation increased ahead of expectations from 1.8% to 2.3% year on year, whilst factory gate prices remained deflationary and were down 4.9% year on year.

Last week’s other events

- The US Federal Reserve’s (the Fed’s) Labour Market Conditions index turned negative, falling from 0.4 to -2.4. This was against an expected improvement to 1, adding to worries over the actual health of the US labour market.

- In the UK industrial production picked up in January, growing 0.2% year on year compared to a -0.2% fall previously. The month-on-month figure was 0.3%, up from -1.1% but shy of an expected 0.5%. Manufacturing also picked up but was still just down from a year before. Production came in at -0.1% year on year, but this was an improvement on the previous month’s -1.7% and ahead of expectations for a reading of -0.7%.

- US import and export prices continued the slide that started in mid-2014 on the back of sustained dollar strength. Month-on-month export prices were down -0.4% and import prices were down -0.3%, although both were improved from the previous readings and marginally ahead of expectations.

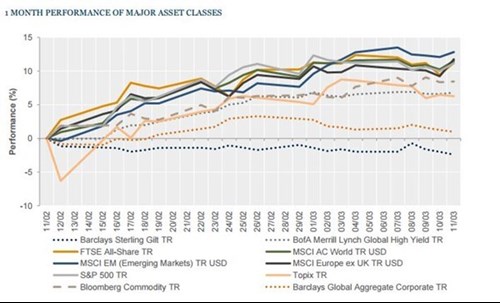

The markets

A volatile and mixed week across asset classes, with European and US equities up whilst equities in the UK and Japan slipped. Sovereign bonds were generally weaker whilst commodities and currencies were relatively uneventful.

Equities – Equities were fairly mixed over the week. After some confusion, European equities were a clear winner – rallying on Thursday and Friday to end the week up 2.4% (as measured by the FTSE Europe ex-UK index). US equities were up 1.1%, with the S&P 500 back above 2000 to finish the week at 2022. The UK and Japan failed to benefit from the rally however, finishing down -1.1% and -1.2% respectively, whilst markets in Hong Kong finished more or less flat on the week at +0.1%.

Bonds – Government bond yields generally rose last week, except for Japan. UK 10-year Gilt yields were 9 bps higher at 1.58% whilst in the US, 10-year yields were just below 2% at 1.98% having risen 10 bps last week. After the ECB decision German Bunds softened from very their tight positions, with 10-year yields 3 bps higher by the end of the week to 0.27%. 10-year Japanese Government Bonds were just back in the red at the end of the week with a yield of -0.01%.

Commodities – After a volatile week, oil was firmer overall with Brent crude ending the week at US$40.39 a barrel. Gold and copper mostly moved sideways, ending at US$1,258.70 an ounce and US$2.24 per lb respectively.

Currencies – The euro gained across the board, finishing up 1.36% against the US dollar, 1.37% against the yen and 0.14% against sterling. Sterling itself was up 1.22% against the US dollar and 1.24% against the yen.

The week ahead

There is a busy week ahead with Central bank action and a raft of economic data. Hot on the heels of the ECB excitement last week, we have three other major monetary policy meetings this week. The other half of the loosening duo, the Bank of Japan, will report overnight Monday/Tuesday – no change expected after the surprise shift into negative rates, but Governor Kuroda has a clear preference for taking markets by surprise.

In the tightening club, the US Federal Reserve meeting concludes on Wednesday and then the Bank of England’s meeting reports on Thursday. No changes to monetary policy are expected in either case, but the details – in the Fed’s press conference and the Bank of England’s minutes release – will likely receive a lot of attention, as will the Fed’s latest economic projections.

Industrial Production figures out of the Eurozone on Monday and the US on Wednesday will also add to the economic picture. We also have the UK Budget reporton Wednesday, though the economic impact of this is usually fairly limited.

As mentioned above, Eurozone industrial production figures are the main release on Monday. Forecasts are for a rebound from last month’s -1.3% year-on-year fall to 1.2% growth. Ahead of this, China will update its rate of Fixed Asset Investment (10.0% in December, with 9.5% expected for January).

Just after midnight, we have output from the Bank of Japan in the early hours of Tuesday morning. Eurozone employment changes are out later in the morning, whilst in the afternoon there is a slew of data from the US including retail sales, PPI inflation and business inventories – the latter could be notable given the contribution inventory changes have been making to GDP.

On Wednesday we start in the UK with unemployment and earnings data. Average earnings are expected to have slightly improved year on year, from 1.9% to 2.0%. This is followed by Eurozone construction output, before the UK Chancellor gives his Budget report just after midday. In the afternoon there are more US data including core inflation, industrial production and house building figures before the Fed’s monetary policy decision is announced in the evening, together with a press conference and the latest economic projections.

Before the Bank of England meeting concludes on Thursday, the Eurozone will release the final reading for February inflation, which will be negative based on early estimates. The Bank of England will release its decision and meeting minutes at midday, and then in the afternoon the US furnishes us with jobless claims and JOLTS job openings.

On Friday China releases the latest house price index reading overnight, and in the afternoon we have the preliminary reading for the Michigan Consumer Sentiment survey. There are speeches from Bank of Japan and US Federal Reserve officials throughout the day, but it’s a fairly quiet end to the week.

Disclaimer

This article was previously published on Tilney prior to the launch of Evelyn Partners.