Weekly macroeconomic and market update - 10 October 2016

Weekly macroeconomic and market update - 10 October 2016

A look back over macroeconomic events for the week ending 07/10/2016. European Central Bank (ECB) tapering rumours and talk of a ‘Hard Brexit’ pushed sovereign bond yields up and sterling down, giving a boost to UK equities. US data did little to alter US interest rate forecasts as we head into US earnings season. A quiet week ahead on the data front, with some mid-level data in the US and Europe towards the end of the week.

Non-farm payrolls fall short of expectations

US non-farm payrolls fell slightly short of expectations, with 156,000 jobs added compared to 175,000 expected. Average hourly earnings grew 0.2% month on month as expected, and both unemployment and the participation rate edged up 0.1% to 5.0% and 62.9% respectively.

Much more positive were the PMI readings from the Institute of Supply Management (ISM), where Manufacturing PMI increased from 49.4 and 51.5 (50.3 was expected) in September. Non-Manufacturing PMI surged from 51.4 to 57.1 (53.0 was forecast). All in all a lot of data, the net result of which has been no real change to the outlook, and the market still sees the US Federal Reserve on course for a December interest-rate hike.

Is a reduction to ECB quantitative easing on the horizon?

A Bloomberg report spooked European sovereign bond markets. Citing anonymous sources close to the ECB, the report suggested the bank was considering tapering back its quantitative easing (QE) programme earlier than expected, possibly in €10 billion per month increments. This also comes as the Bank of Japan is shifting its monetary policy away from simple money injection, and towards controlling the yield curve, which could itself amount to a tapering.

The story has been strenuously denied by the Central bank, and many are naturally sceptical of the rumour, particularly while inflation in both the Eurozone and Japan remain well below target. However, we have long maintained that the efficacy of unconventional monetary policy was weak to start with and has been falling – along with Central bank credibility – ever since. Unlike when the US Federal Reserve (Fed) began tapering its programme as it saw economic recovery take hold, any tapering in the Eurozone and Japan is likely to be more related to the realisation that QE simply isn’t working.

‘Hard Brexit’ rumours cause a sterling flash crash

Sterling had another tough week, falling further against other major currencies on fresh Brexit fears. Prime Minister Theresa May sparked fears of a ‘Hard Brexit’ by prioritising immigration over access to the European Union single market, and announcing late March 2017 as a likely trigger date for Article 50. The moves triggered a sterling “flash crash” in the early hours of Friday morning (UK time), most likely caused by trading algorithms going awry, which was quickly reversed.

Last week’s other events

- UK Manufacturing PMI unexpectedly improved from 53.3 to 55.4 in September, defying forecasts of a slip to 52.1. Services PMI slipped 0.3 to 56.2, though this was better than the 56.0 expected. However, industrial production figures for August deteriorated to 0.7% year on year from 2.1% in July and expectations of 1.3%.

- Eurozone retail sales for August disappointed, slowing from 1.8% year on year to 0.6% (1.5% had been forecast).

- Japan’s leading economic indicator index improved from 100 to 101.2 (though 101.7 was expected).

- In China, the privately-run Caixin Services PMI was relatively unchanged, at 52.0 from 52.1.

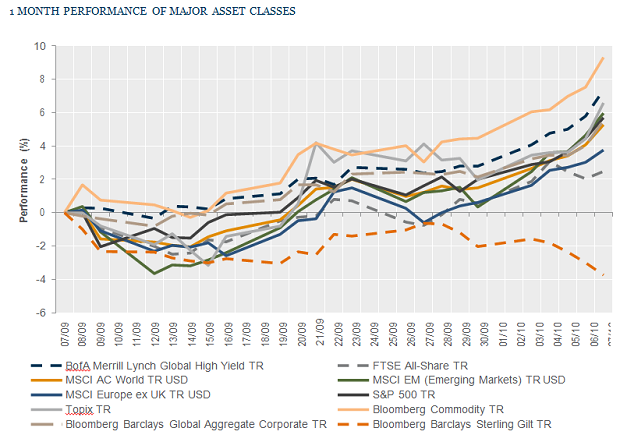

The markets

It was a decent week for sterling investors, as a weakening sterling caused UK equities to rise, although government bonds and gold were both down on the week.

Equities

FTSE All-Share index returned 2.0% on the week, with the FTSE 100 back above 7,000. The S&P 500 slipped -0.7%. European Equities, as measured by the FTSE Europe ex-UK index was down -0.9%. In Japan, the Topix advanced 2.1% and the Hang Seng index of equities in Hong Kong increased 2.2%.

Bonds

10-year gilt yields shifted sharply higher on the week, up 22 bps at 0.98%. The equivalent German bund yields were back in the black, yielding 0.01% but a significant move from the -0.12% of a week earlier. Treasury yields were up 13 bps to 1.72%.

Commodities

Brent crude continued to strengthen throughout the week, ending at US$51.93 per barrel. Copper reversed recent gains to finish at US$2.16 per lb and gold weakened by more than US$50 to finish the week at US$1,249 an ounce.

Currencies

On the back of various political comments, sterling weakened sharply against major currencies, finishing at US$1.24, €1.11 and ¥128.

The week ahead

It is a fairly quiet week ahead. Wednesday sees the release of the Federal Open Market Committee (FOMC) minutes as well as industrial production for the Eurozone in August, which is forecast to have rebounded from -0.5% year on year to 1.4%. There’s a little more newsflow on Friday – overnight China’s inflation figures are released, with expectations of the headline rate having increased to 1.6% year on year. In the afternoon US retail sales are forecast to be up from -0.3% month on month in August to 0.6% in September. Elsewhere:

There is nothing to report on Monday. On Tuesday morning the ZEW survey of German business sentiment is released, then in the afternoon the Fed’s Labour Market Conditions report comes out. Wednesday sees the release of Eurozone industrial production figures, the FOMC minutes and the US JOLTs job openings.

Early on Thursday morning Chinese trade data are reported, then the US equivalent are released in the afternoon. As we enter Friday, the Chinese Producer Price Index is released alongside headline inflation. In the afternoon US PPI, business inventories and the Michigan Consumer Sentiment index data are updated along with the retail sales discussed above.

Disclaimer

This article was previously published on Tilney prior to the launch of Evelyn Partners.