Weekly macroeconomic and market update 25 January 2016

Weekly macroeconomic and market update

Is there action on the horizon for the ECB?

Despite holding monetary policy steady, ECB President Mario Draghi gave some cheer to stimulus-hungry markets by indicating that fresh action may come at the next meeting in March. Deposit rates remained at -0.30% and quantitative easing (QE) remains in effect at a rate of €60 billion a month until at least March 2017, but the rhetoric from the President was decidedly dovish.

He talked of “the power, the willingness, the determination to act, and the fact that there are no limits to our actions”, suggesting action “without undue delay” as he sought to combat the inflationary effects of a slowing China and falling oil prices. This, and other sections of fairly punchy language, could signal that Mr Draghi has managed to talk around some of the committee members who we know where reluctant to act aggressively in December – leading to action that was more limited than the market had expected, dubbed “Draghi’s Disappointment”.

Yet more disappointment from China

Chinese data were also a source of disappointment. Full-year GDP came in as expected at 6.9%, a slowdown from the 2014 figure of 7.3%. This confirms the continued and officially-recognised economic slowdown, which is focused on the industrial sector. Perhaps of more concern was the disappointment from the other economic numbers released simultaneously – Fixed Asset Investment growth slowed 0.2% to 10.2% (forecasts were that this would remain steady), whilst industrial production fell to 5.9% from 6.2% (6.0% was expected). Retail sales also fell 0.1% to 11.1% (forecasts were for a similar magnitude increase).

Last week’s other events

- In the UK, the Governor of the Bank of England gave a speech in which he made clear that “now is not yet the time to raise interest rates”. Sterling immediately slipped lower as markets adjusted to a more dovish Bank of England. This came as CPI inflation came in at 0.2% year on year in December, while the core inflation measure ticked up to 1.4%. However, retail sales were weaker than hoped with year-on-year growth of just 2.6% in December (4.3% was expected).

- In the US, year-on-year inflation was also up by 0.2% to 0.7%, whilst core inflation strengthened to 2.1%, in line with expectations. US manufacturing PMI improved to 52.7 (51.1 was expected).

- As a backdrop to the ECB meeting, various Eurozone economic measures highlighted a sombre mood. ZEW economic sentiment survey readings fell to 22.7 in January from 33.9 in December (27.9 had been expected), and consumer confidence slipped further to a reading of -6.3 from -5.7 (expectations were that it would stay the same). Adding to the gloom, the composite PMI reading also deteriorated more than expected from 54.3 to 53.5.

- In the US, 4 million barrels of oil were added to capacity in the week ending 15 January, over one million more than the 2.8 million expected.

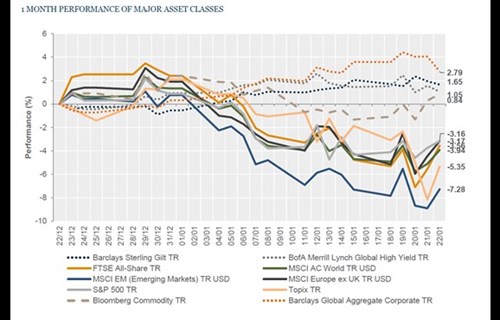

The markets

Risk markets generally recovered some poise this week as developed equities and commodities rebounded, although Asian equities remained under a cloud.

Equities – FTSE All-Share gained 1.2%, in the US the S&P 500 was up 1.4% after being closed for Martin Luther King Day, and Europe (excluding the UK) gained 1.7%. In the Far East, Japanese equities fell 2.0% after the week despite a bounce on Friday, whilst the Hang Seng was similarly down 2.2%.

Bonds – Yields were slightly higher throughout the week. 10-year gilts fell 7 bps to 1.72% whilst 10-year US Treasuries were 3 bps higher at 2.06% and German 10-year Bunds were just 1 bps up at 0.48%.

Commodities – Despite increased storage levels oil managed to stage a rally at the end of the week, with Brent crude back above the US$30 per barrel mark to end at US$32.34. Gold also strengthened, finishing just shy of the US$1,100 an ounce mark at US$1097.20. Copper also rallied to US$4,468 a tonne.

The week ahead

Central banks will be watched closely this week. After the ECB’s signals for more easing, there will be a lot of interest in the statement from the US Federal Reserve on Thursday following a two-day meeting, although there is no press conference scheduled. Then on Friday, the Bank of Japan concludes its monetary policy meeting, and investors will be keen to find out whether they will join the ECB with further explicit policy weakening (after an odd ‘technical’ easing at the end of last year). On Thursday and Friday we also have fourth-quarter GDP results for both the UK and the US – the UK figure is expected to have ticked up in the fourth quarter, whilst the US is thought to have slowed.

On Monday we have German IFO economic surveys and the latest UK Business Optimism Index. On Tuesday this is followed by Markit Composite and Services PMIs, consumer confidence and house price data from the US – all of which are expected to hold steady in support of a broadly growing economy.

As we reach midweek, we have UK house price data on Wednesday morning and new home sales in the afternoon. There will also be energy stock levels from the US and Japanese retail sales figures in the evening.

On Thursday UK fourth quarter GDP figures are expected to show a slowdown to 1.9% year on year. After this, the Eurozone has economic and industrial sentiment numbers, then in the afternoon the US releases a raft of data including durable goods, initial jobless claims and pending home sales. Later in the evening, Japan releases a batch of its own economic data covering inflation, unemployment and industrial production.

We then finish the week with a busy day on Friday. After the Bank of Japan decision, the Eurozone will release inflation data, with year-on-year inflation expected to have ticked up by 0.2% to 0.4% and core inflation expected to remain at 0.9%. At lunchtime (UK time) the US will release its fourth quarter GDP figures, which are expected to have fallen to 0.8% annualised from 2.0% in the third quarter.

Data correct as at 25/01/2016. Source: Lipper.

Disclaimer

This article was previously published on Tilney prior to the launch of Evelyn Partners.